The PIONEER Optimiser (2017)

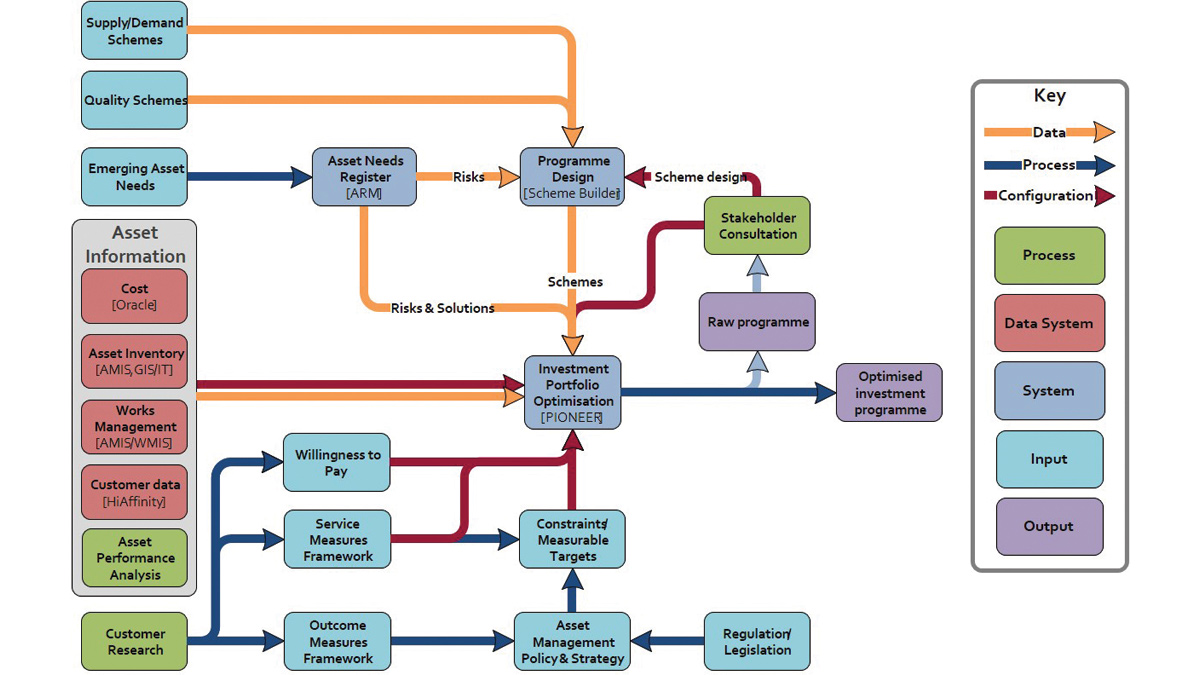

Figure 1: Process for Investment Portfolio Optimisation - Courtesy of Servelec Technologies

At the 2014 Price Review in England & Wales, the economic regulator Ofwat (2013) gave water companies a challenging set of objectives in preparing their business plans. These included a major shift towards outcomes-based regulation, with all business plan investment requirements being justified on the basis of outcomes for customers and the environment, and with new Outcome Delivery Incentives required to incentivise delivery. Companies who exceeded Ofwat expectations in their business plan submissions would be awarded ‘Enhanced Status’, which would mean that their business plans would be accepted substantially unchanged, without the need for further submissions. Of the nineteen water companies in England & Wales, Affinity Water was one of only two that achieved Enhanced Status (Ofwat, 2014). This paper assesses the reasons for their success, with particular focus on the planning of their investment programme using a portfolio optimisation approach.

Introduction

Affinity Water the UK’s largest water-only company supplying to 3.6 million people in south-east England. Affinity optimised its production and network investment options using Servelec Technologies’ PIONEER optimisation tool. The company area was considered as eight distinct ‘communities’. The investment plan was optimised to achieve service targets at least discounted cost both at community level and for the company as a whole. This resulted in reduced costs whilst making environmental improvements, tackling leakage and reducing customer interruptions.

Methodology

The planning methodology applied was as follows (Figure 1 top of page):

- The service and cost impacts of asset deterioration were forecast through a combination of models implemented within PIONEER and external modelling tools from which results were imported. A wide range of service impacts were considered such as water quality, interruptions and leakage.

- Emerging site-specific asset-related risks were identified and assessed manually, and quantified within PIONEER using the Asset Risk Management (ARM) interface.

- Generic and site-specific intervention options were defined to address impacts due to 1 and 2 above.

- Quality and supply-demand schemes were defined using the PIONEER Scheme Builder interface, to allow automatic calculation of capital and operational costs, and carbon emissions.

- The PIONEER optimisation algorithm was applied to select the optimal set of intervention options and schemes that will meet service measure targets at least cost.

The PIONEER optimiser allows multiple service and cost constraints to be applied in each planning timestep. Discounted costs are minimised across a user-defined planning horizon, taking account of capital costs, failure-related costs (e.g. repairs and compensation), other operational costs where modelled (e.g. pumping energy), and any modelled social and environmental costs.

The risk model applied takes account of:

- Likelihood of failure (physical deterioration and performance).

- Unavailability.

- Redundancy.

- Likelihood and expected quantity of each consequence, given that a failure has occurred.

- Criticality of asset within the facility, and of the facility within the overall supply system.

- Costs (maintenance, repair, energy, carbon, environmental).

- Customer willingness to pay for changes in service (Optional).

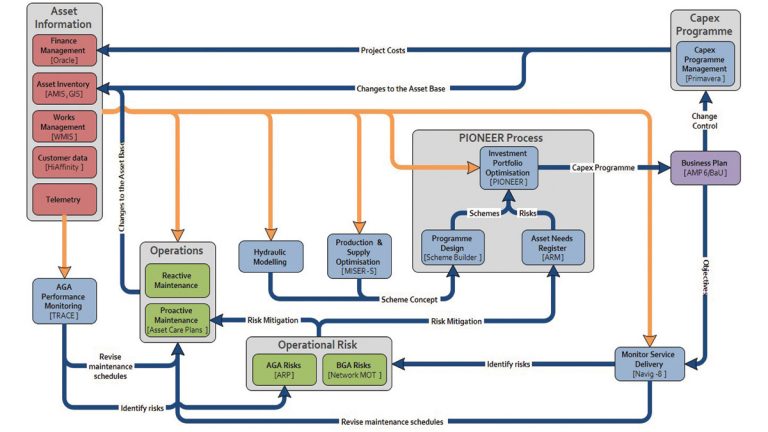

Figure 2: Wider Asset Management Context – Courtesy of Servelec Technologies

Figure 2 (above) shows the wider Affinity Water asset management context within which this methodology sits.

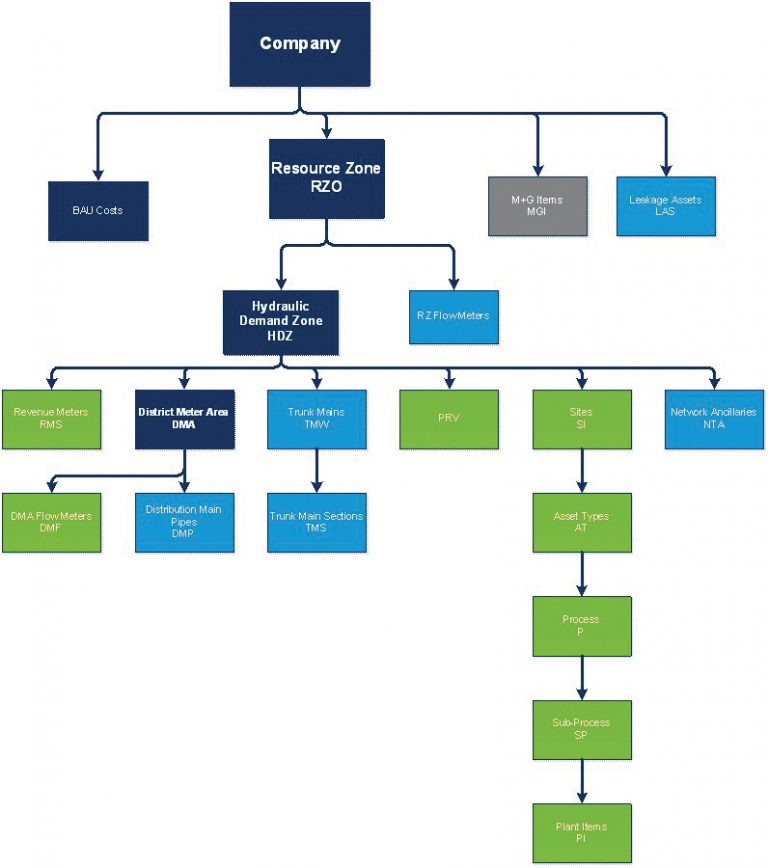

All principal network and production asset types were assessed, with asset data arranged within a hierarchy structure as shown in Figure 3 (below).

This approach represented a significant step forward from the previous price review (2009) where the frequency of renewal was assessed individually for each asset type, without any true optimisation across asset groups.

Figure 3: Asset Hierarchy – Courtesy of Servelec Technologies

About PIONEER

PIONEER is decision-support software for optimal asset management planning. The software has delivered benefits to clients over many years including:

- Capital cost savings of over 10% due to optimisation of investment. Improved levels of service to customers and increased customer satisfaction.

- Increased funding through improved justification of needs.

- Consistent decision-making leading to more effective planning.

PIONEER is comprised of:

- A hierarchical asset data store that collects together data from a number of sources for use in service forecasts and optimisations.

- A Service and Cost Forecaster that stores user-configured models for estimating future values of service and costs, with and without capital and operational interventions.

- An Intervention Option Generator that allows users to configure intervention options to be considered by the optimiser.

- An Optimiser that selects the interventions required to meet service targets or spending objectives.

- A Job Scheduler for batch running of forecasts and optimisations.

- Flexible tools for results presentation and reporting.

The PIONEER ARM module provides Operational and Asset Managers with the means of capturing and assessing non-modelled asset-related risks, and of assessing and comparing the costs and benefits of potential solutions. PIONEER Scheme Builder provides asset managers with the means of quickly and easily creating, costing and assessing complex investment schemes. Both ARM ‘solutions’ and scheme builder ‘schemes’ can be considered alongside other intervention options within the PIONEER optimiser.

Outcome

Affinity Water’s business plan (Affinity Water, 2013) delivers an integrated package of benefits, better managed assets by focusing maintenance investment on service and risk and reduced water use and waste whilst maintaining the quantity and quality of the water supply. This results in a better service overall, without extra risk being incurred by the company, the customer or the environment.

The overall costs of providing services presented in the plan were lower than those assessed by the Ofwat econometric modelling. This was at least partly due to the savings achieved by optimisation of the asset maintenance portfolio.

This optimisation has enabled the company to achieve an improved balance between reactive and planned interventions, and between network and production investments. This reduced the total cost, whilst achieving the required regulatory performance commitments. Each of these performance commitments was aligned with the outcomes desired by Affinity’s customers (Figure 4 below).

Figure 4: Customer Outcomes – Courtesy of Servelec Technologies

Investment in each community is optimally balanced, taking into account the existing asset stock and future service requirements. Bills are set at the company level, but interventions are planned to ensure that service does not deteriorate within each community, taking account of both previous investment and future issues. In awarding Enhanced Status, Ofwat commended Affinity Water in a number of areas, including:

- Presenting convincing evidence that the business plan is efficient.

- Presenting an innovative company plan and vision, including the reporting of performance at a community level.

- Proposing Outcome Delivery Incentives which provide a plausible and acceptable basis to incentivise performance.

- Successfully identifying the major challenges that the company faces (in particular a supply/demand deficit) and providing solutions that are well supported by customer engagement.

One of the key success factors in providing the confidence in the plan was the relative transparency and openness of PIONEER, enabling audit and board assurance. Integration of ‘business as usual’ by capturing operational risks using ARM and Scheme Builder to drive the investment programmes at concept stage also meant that the operational teams were engaged. Refurbishment and repair options as well as replacement options, and the ability to link individual asset investments to service and customer outcomes, meant Affinity could demonstrate the link between investments and what customers said they wanted. Another success factor was that the plan was deliverable; pipelines were replaced in sensible schemes and not short sections that had inflated cost-benefit. This meant that the final plan could easily be translated into an achievable delivery programme.

Future developments

Future developments will include:

- Monitoring performance and reporting back to each community individually.

- Regular and consistent reviews of investment prioritisation, portfolio-wide.

- Further focus on ‘Totex’ solutions, considering operational activity as an investment choice from the bottom up.

- Preparations for different service and pricing levels for each community if customers or non-household retailers want this.

- Greater integration of deterioration models for pipelines and production assets, so that there is less data manipulation and dependency on other tools.

- Further exploration of uncertainties from risk and cost calculations.

REFERENCES

- Affinity Water. December 2013. Our Business Plan for 2015-2020. Hatfield, UK.

- Ofwat. July 2013. Setting price controls for 2015-20 – final methodology and expectations for companies’ business plans. Birmingham, UK.

- Ofwat. December 2014. Setting price controls for 2015-20, Final price control determination notice: company-specific appendix – Affinity Water. Birmingham, UK.